Need For a Low Doc Loan

When you apply for a low-doc home loan, you need to provide certain documents that a lender will need to assess your application. Low-doc loans are best suited for unconventional or self-employed borrowers. Because of the increased risk for lenders, most low-doc loan providers will require a minimum 20% deposit. Additionally, you cannot borrow more than 80% of the value of the property.

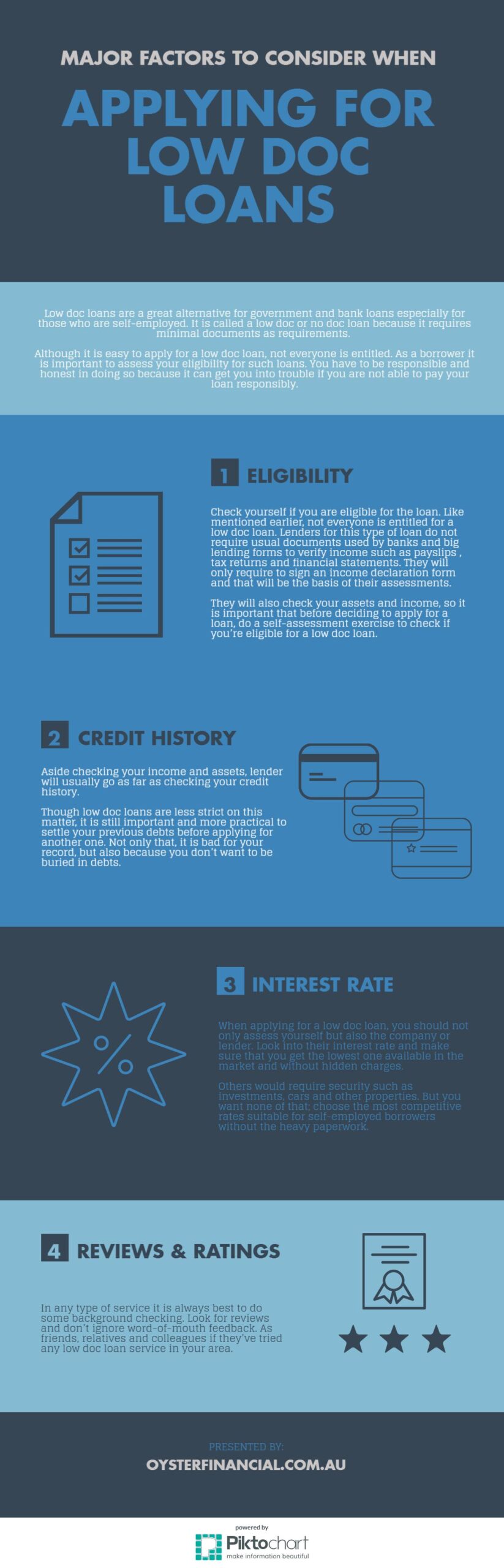

In addition to your financial situation, you also need to provide your credit file and repayment history to qualify for a low-doc loan. While self-employment is not considered a limiting factor, it can cause trouble when it comes to obtaining a mortgage. If you are married or have a significant other who works at home with you, joint business ownership will complicate the loan application process. While your application will likely be approved, you should expect to pay higher interest rates and a lower percentage of the property value.

If you are self-employed, you can apply for a low doc loans. However, the qualifications for this type of loan will vary between lenders. Often, you’ll need an Australian Business Number (ABN), a registered business name, and recent bank statements to qualify for a low-doc loan. You can also provide supporting documents such as a statement of your income.

What Do You Need For a Low Doc Loan?

If you’re a self-employed applicant, a low-doc loan is likely to be easier to obtain. The documents you provide are often not as extensive as you think. Typically, a low-doc personal loan will require less documentation than a typical loan, such as two years of income tax returns, profit and loss financial statements, and ATO assessments. A low-doc loan will require a minimum of these documents, such as an ABN or ACN certification, a 12 month BAS statement, and an identity certification, but you may be required to provide a letter from your accountant.

To qualify for a low-doc home loan, you should pay a higher down payment than you would for a conventional mortgage. Most conventional mortgages require at least 20% of the purchase price, while non-qualified mortgages demand at least 40%. By putting more money down, you can build up some equity and pay down the loan later. Non-qualified borrowers are riskier for lenders because they can’t prove their ability to repay the loan, and the higher price reflects this risk.

If you’re self-employed or freelance, a low-doc loan is a great way to get the money you need. The biggest downfall of a low-doc loan is that the lender will require a larger down payment than you can afford. A low-doc loan may be the best option for you if you’re self-employed or have an independent contractor or freelance business.