Trade Carbon

Whether you are looking for a new investment or you just want to diversify your portfolio, investing in carbon credits is one way to reduce the amount of global pollution you generate. You can invest directly in a carbon project or indirectly through trading the credits you have purchased.

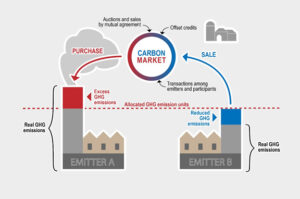

A trade carbon credits is a permit that gives a company the right to emit a metric ton of carbon dioxide over a certain period of time. These permits are sold in the international market at prevailing market prices.

To determine the price of a carbon credit, many factors are considered. The quotas set by the government for emissions are taken into consideration, as well as the financial impact of carbon markets on business. In some cases, a carbon tax is levied, and in other cases, the price of carbon is regulated to stabilize its value. There are also economic incentives to encourage companies to reduce their pollutants.

Can Anyone Trade Carbon Credits?

Carbon markets are found all over the world. Some states, such as Massachusetts, Connecticut, and Maine, have formed Regional Greenhouse Gas Initiatives. These initiatives aim to reduce the amount of greenhouse gases emitted from the power sector. Other regions, such as California, are experimenting with lowering their carbon price. However, it is difficult to predict what the future holds for the carbon market.

The United Nations Framework Convention on Climate Change (UNFCCC) regulates the carbon market, and each country has to follow the rules in order to qualify. A country can sell or transfer credits to another country, or it can limit its own emissions. It can also enter into a contract with another company to buy the carbon credits it needs.

Typically, industrial projects produce more credits, which are then traded in the international market. These projects are often larger scale, and more easily verified as being capable of offsetting GHG emissions.

Community-based projects, on the other hand, are generally localized and smaller. They are managed by local groups, and they usually produce more co-benefits than industrial projects. Because of this, they can trade at a premium to industrial projects.

If a company wants to offset its emissions, it can buy a specific number of allowances from other companies that have achieved high levels of emission reduction. These companies can then sell their excess allowances in the market, or they can use the credits to reduce their own emissions.

The European Union has developed a system to verify the ownership of credits transferred within the EU. It is also possible to trade credits between countries, as long as they meet certain criteria. This can be done through national registries, which must be validated by the UNFCCC.

Whether you are interested in investing in carbon credits or not, it is important to understand the risks involved. You may want to speak with a financial advisor. If you do not have a financial advisor, you can utilize a free tool such as SmartAsset to find a financial planner to help you make an informed decision.