Carbon Credit Exchanges Do

The carbon credit market has grown rapidly in recent years, spurred by corporate net-zero goals and interest in meeting international climate targets. But it remains fragmented, with buyers and sellers connecting through over-the-counter markets. In response, several blockchain startups are developing platforms to streamline the trading process. But they are being cautious, focusing on integrity and promoting transparency over liquidity.

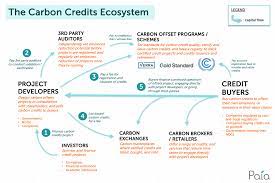

Carbon brokers function like stockbrokers, except they facilitate the purchase and sale of carbon credits. They offer access to the over-the-counter markets and charge a fee for their services.

They may also help project developers develop and market carbon offset projects. Some brokers also shoulder the upfront costs of these projects. However, they often earn a large chunk of the revenue from selling these carbon credits. Some of that money goes back to the broker for facilitating the transaction and other expenses, while the rest is used to pay for project monitoring, reporting, and verification (MRV).

In the voluntary carbon market, companies can purchase credits from those who reduce, avoid, or capture greenhouse gas emissions, which they then use to offset their own emissions. The credits are usually created through agricultural or forestry practices, but they can be made from nearly any project that reduces emissions. Those who receive the carbon credits can then sell them to individuals or corporations that want to offset their own emissions. The credits are also traded in the compliance market, where governments set a cap on how many tons of emissions industries can release.

What Does Carbon Credit Exchanges Do?

While the current voluntary carbon market lacks the liquidity needed to enable efficient trading, some companies are looking for ways to improve it. One potential solution involves using blockchain to link up the different data systems that currently manage the information on carbon credit exchange and other attributes. This could create a meta-registry that aggregates metadata into a publicly accessible database, making it easier for traders to locate available credits and confirm their attributes.

Another option is to build new, standardized contracts for the voluntary carbon market. These would combine a core contract, based on the basic principles of the current VCM, with additional attributes that are defined according to a standard taxonomy and priced separately. These could be traded alongside existing contracts and would make it easier for buyers to find what they are looking for.

Besides building these new standards and creating exchanges, blockchain startups are also working to make settlement of carbon credits more efficient. They aim to reduce the time it takes for buyers and sellers to settle transactions, and to improve the efficiency of transferring credits between accounts. This will enable buyers and sellers to access the carbon credit market without having to wait for a settlement to be finalized in a central registry.

In addition to increasing the amount of liquidity in the carbon market, these blockchain initiatives are also promoting greater environmental integrity. This is crucial in a market that relies on third parties to verify and validate the carbon credit supply chain.