Small businesses often prefer to treat workers as independent contractors for several reasons: to avoid the hassle of calculating and paying employee withholdings; escape the expenses required by the employer for unemployment insurance, workers’ compensation and other costs; and absence of overtime and other wage and hour regulations. In short, treating employees as “independent contractors” can have a strong pull in a small business.

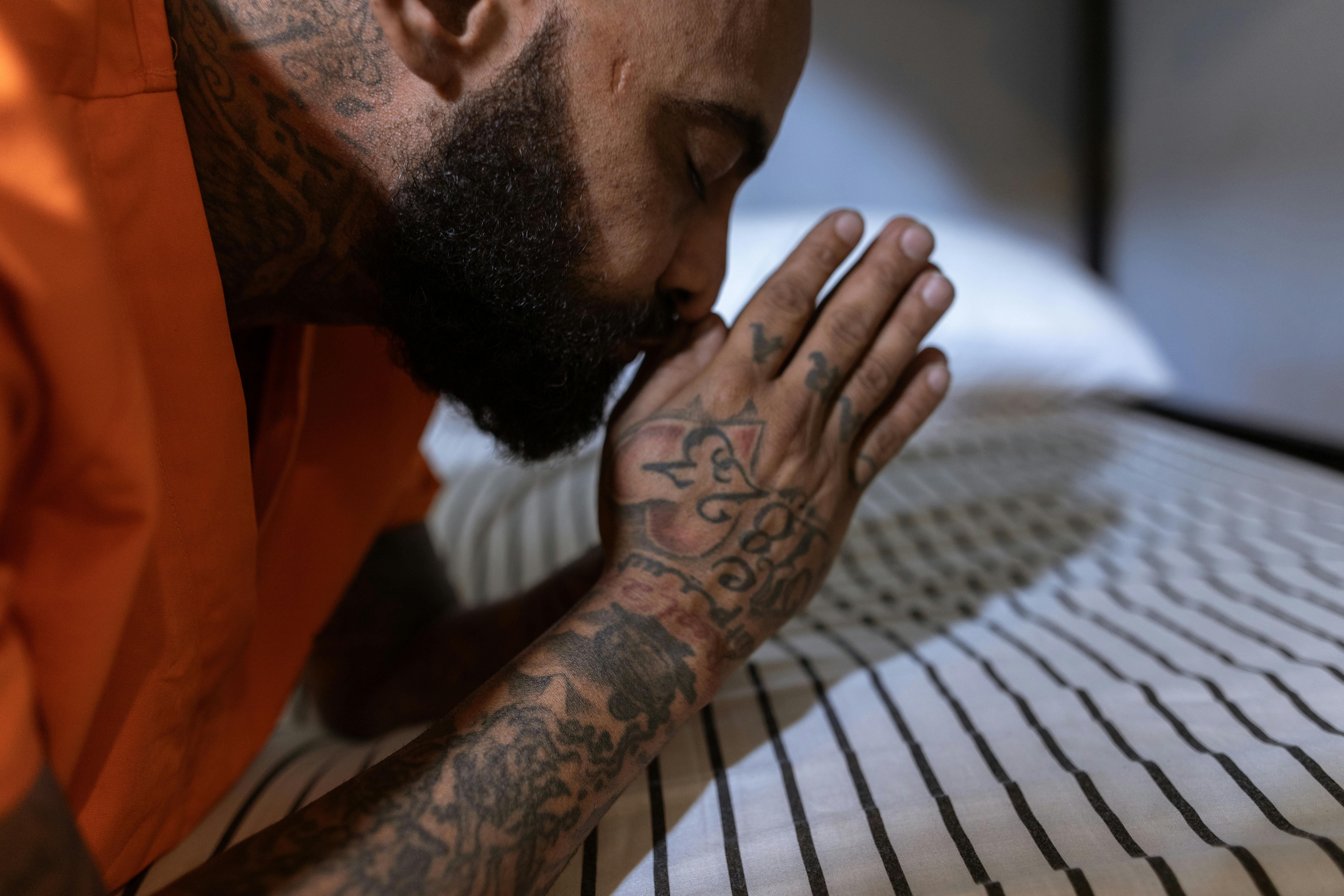

Like many other strong temptations, treating an employee as an independent contractor can also lead directly to hell if the employee is not. The litany of hellish consequences, both for an employer and its responsible officials and owners of capital, is alarming.

First are the unpaid withholdings for which not only the employer but also its responsible officers and directors may have personal joint and several liability. Officers, directors, members, managers, partners, and limited liability partners are also personally liable, jointly and severally, with their business entity and each other for all claims costs, civil penalties, and attorneys’ fees if it is determined that the ” independent contractor “was actually an” employee “when he was injured while on the job. SRO 656,735.

When a misclassified employee is injured on the job, not only is he free to bring a personal injury action against his employer, but the employer loses the benefit of any defense based on the employee’s own contributory negligence. ORS 656.020.

Similarly, persons responsible for an employer’s unemployment insurance compliance may be personally, jointly and severally liable to each other and to their employer for the unemployment benefits and claims costs of an employee wrongly classified as an independent contractor. ORS 657,516.

Consequently, treating anyone who provides services to a business as an independent contractor is a decision that should be made with caution. One mistake could not only hurt your business, but also drain your personal finances.

© 12/12/2013 Lawrence B. Hunt of Hunt & Associates, PC All rights reserved.